Some Ideas on Feie Calculator You Need To Know

Table of ContentsSome Known Questions About Feie Calculator.5 Easy Facts About Feie Calculator ExplainedHow Feie Calculator can Save You Time, Stress, and Money.Some Ideas on Feie Calculator You Should KnowFeie Calculator Can Be Fun For AnyoneFeie Calculator Things To Know Before You Get ThisThe 8-Second Trick For Feie Calculator

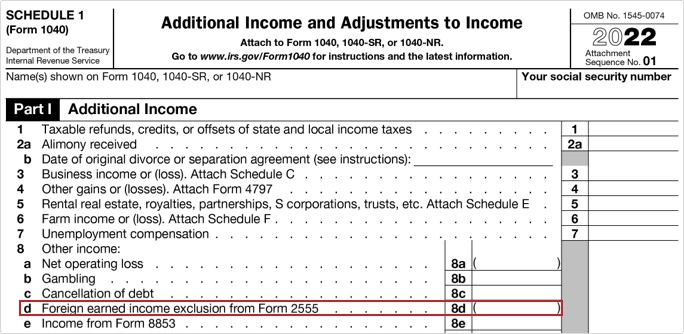

If he 'd frequently traveled, he would rather complete Component III, providing the 12-month period he satisfied the Physical Existence Examination and his traveling history. Step 3: Reporting Foreign Income (Part IV): Mark earned 4,500 per month (54,000 annually).Mark calculates the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his wage (54,000 1.10 = $59,400). Given that he resided in Germany all year, the percent of time he resided abroad throughout the tax is 100% and he gets in $59,400 as his FEIE. Ultimately, Mark reports overall earnings on his Form 1040 and enters the FEIE as an adverse quantity on time 1, Line 8d, reducing his gross income.

Selecting the FEIE when it's not the most effective alternative: The FEIE may not be optimal if you have a high unearned income, gain more than the exemption limit, or reside in a high-tax country where the Foreign Tax Credit (FTC) may be much more valuable. The Foreign Tax Credit History (FTC) is a tax decrease approach often used together with the FEIE.

Things about Feie Calculator

deportees to offset their united state tax debt with foreign earnings taxes paid on a dollar-for-dollar reduction basis. This means that in high-tax nations, the FTC can usually remove U.S. tax debt completely. Nevertheless, the FTC has restrictions on qualified tax obligations and the maximum insurance claim amount: Qualified taxes: Only income taxes (or tax obligations in lieu of revenue tax obligations) paid to foreign governments are eligible.

tax obligation liability on your international income. If the international taxes you paid exceed this restriction, the excess foreign tax can usually be lugged forward for up to 10 years or returned one year (via a changed return). Keeping accurate documents of foreign revenue and tax obligations paid is for that reason important to computing the right FTC and maintaining tax obligation conformity.

migrants to reduce their tax responsibilities. For example, if an U.S. taxpayer has $250,000 in foreign-earned income, they can exclude up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 may after that be subject to taxation, but the U.S. taxpayer can potentially apply the Foreign Tax Debt to balance out the taxes paid to the foreign country.

Things about Feie Calculator

He sold his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his better half to help satisfy the Bona Fide Residency Test. Neil points out that acquiring property abroad can be challenging without first experiencing the area.

"It's something that individuals require to be truly persistent concerning," he says, and encourages deportees to be cautious of typical blunders, such as overstaying in the United state

Neil is careful to mindful to U.S. tax authorities that "I'm not conducting any performing any type of Service. The U.S. is one of the few nations that tax obligations its people regardless of where they live, indicating that also if a deportee has no income from U.S.

How Feie Calculator can Save You Time, Stress, and Money.

tax returnTax obligation "The Foreign Tax obligation Credit history enables people working in high-tax nations like the UK to counter their U.S. tax obligation liability by the amount they've already paid in tax obligations abroad," claims Lewis.

The possibility of lower living prices can be alluring, yet it frequently includes trade-offs that Foreign Earned Income Exclusion aren't right away noticeable - https://www.giantbomb.com/profile/feiecalcu/. Housing, for instance, can be much more cost effective in some countries, yet this can indicate jeopardizing on framework, safety, or access to trustworthy utilities and solutions. Affordable buildings could be located in areas with irregular net, minimal mass transit, or unstable medical care facilitiesfactors that can considerably impact your daily life

Below are several of one of the most often asked concerns about the FEIE and other exclusions The Foreign Earned Revenue Exclusion (FEIE) allows U.S. taxpayers to leave out as much as $130,000 of foreign-earned earnings from federal revenue tax obligation, lowering their U.S. tax obligation liability. To get FEIE, you should satisfy either the Physical Existence Examination (330 days abroad) or the Authentic House Examination (verify your main residence in a foreign country for a whole tax year).

The Physical Presence Test likewise requires U.S. taxpayers to have both a foreign revenue and an international tax obligation home.

The 9-Second Trick For Feie Calculator

An income tax treaty between the united state and another country can assist stop double tax. While the Foreign Earned Earnings Exclusion decreases taxable earnings, a treaty may supply extra benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Record) is a called for declaring for U.S. residents with over $10,000 in foreign financial accounts.

The international made earnings exemptions, often described as the Sec. 911 exemptions, leave out tax obligation on earnings gained from functioning abroad. The exemptions consist of 2 components - a revenue exclusion and a housing exemption. The adhering to Frequently asked questions talk about the advantage of the exclusions including when both partners are expats in a general fashion.

Not known Details About Feie Calculator

The earnings exemption is now indexed for rising cost of living. The optimal yearly income exemption is $130,000 for 2025. The tax benefit excludes the revenue from tax obligation at bottom tax prices. Previously, the exclusions "came off the top" decreasing income topic to tax obligation on top tax prices. The exemptions might or might not decrease revenue used for various other functions, such as IRA restrictions, child credits, individual exemptions, etc.

These exemptions do not excuse the wages from US tax yet merely provide a tax reduction. Keep in mind that a solitary person working abroad for all of 2025 who made concerning $145,000 with no other revenue will certainly have taxed income minimized to absolutely no - successfully the very same answer as being "free of tax." The exclusions are calculated on a day-to-day basis.

If you attended service conferences or seminars in the United States while living abroad, income for those days can not be omitted. For US tax obligation it does not matter where you maintain your funds - you are taxed on your worldwide revenue as a United States individual.